Home » Uncategorised »

Calls for Unregulated Eviction Firms to Join a Redress Scheme

This article is an external press release originally published on the Landlord News website, which has now been migrated to the Just Landlords blog.

Landlords simply cannot afford to restart the eviction process after an unregulated firm has failed to offer the correct service, insists Landlord Action, which is calling for unregulated eviction firms to join a redress scheme.

Over the years, Landlord Action has been instructed to take on several cases following the malpractice of another firm. With repossessions for landlords now taking an average of 43 weeks, Landlord Action insists that landlords simply cannot afford to restart the process due to compliance errors.

Calls for Unregulated Eviction Firms to Join a Redress Scheme

It is calling for unregulated eviction firms to become part of a redress scheme to help clean up the industry and protect landlords and letting agents from further unnecessary expense.

As the private rental sector has grown, so too has the eviction industry and, with it, the number of unregulated eviction firms cutting corners and not using legally qualified personnel to facilitate the process correctly.

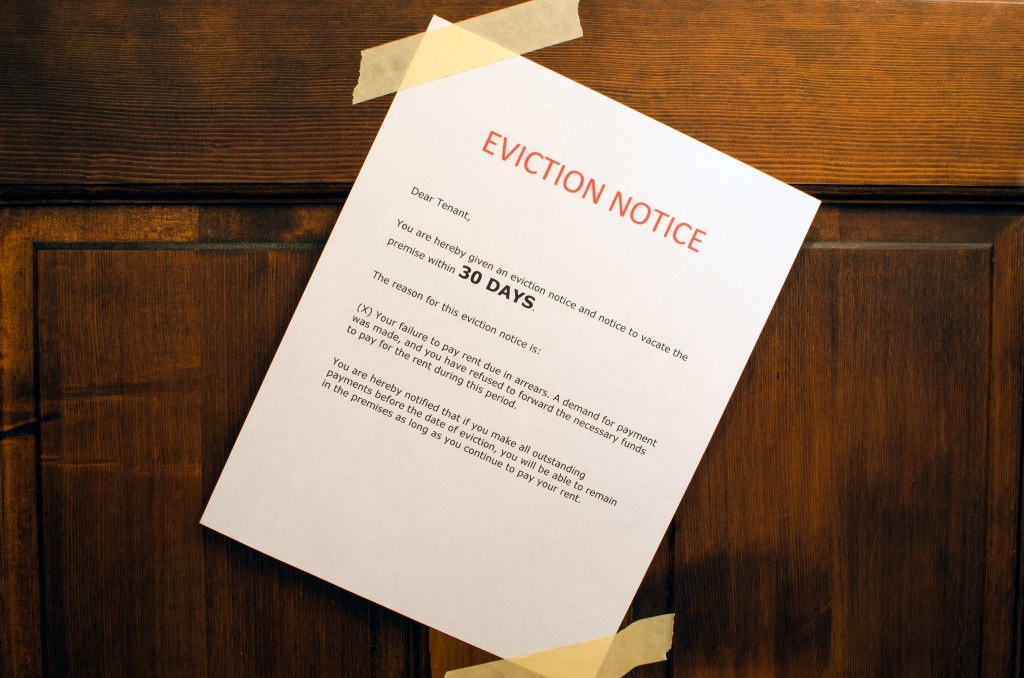

One landlord, Ms. Romeena Hadwal – who, like many people, turned to the internet for advice when her tenant fell into rent arrears – found herself battling the very company she had instructed to help her.

She explains: “I found a company on the internet which was offering what appeared to be a very good deal – £99 to get started and a money-back guarantee. I spoke to them on the phone; they seemed perfectly legitimate, explained the process to me, took payment and filed notice, which my tenant received.

“However, problems started when it transpired they had put the wrong address on the court forms, which delayed the entire process. Under the impression it had been resolved, the case went to court, but, four weeks after the hearing, I was told I was unable to apply for the N325 Request for Warrant of Possession because the address was still incorrect. I wish I had gone to a regulated law firm.”

Communication between Hadwal and her eviction company became increasing hostile, until the firm stopped responding altogether. Six months on, she was still no closer to getting her property back and had paid a total of £855 to a company that had not helped her to evict her tenant.

Commenting on unregulated eviction firms, David Smith, a Partner and Head of Operations at Anthony Gold Solicitors, says: “Unregulated providers of advice to landlords look like a good deal at first blush. However, they can provide advice which is misleading or plain wrong, and the lack of insurance or a complaints process leaves landlords with nowhere to turn when things go wrong. A robust complaints mechanism is a key component of giving landlords confidence in the reliability of such services.”

With nowhere to take her complaint and mounting rent arrears, Hadwal was desperate to get her property back. Her only choice was to instruct another eviction company. She contacted Landlord Action, which took the case over, and Hadwal now has an eviction date set for 1st August 2017.

Paul Shamplina, the Founder of Landlord Action, comments on the success of his firm: “When we set up as the UK’s original three-step fixed-fee eviction company, the aim was to provide simplicity to a previously costly and complicated burden for landlords and letting agents. As other operators have entered the marketplace, we’ve found ourselves working with more and more landlords who have not only been let down by their tenant or letting agent, but subsequently their unregulated eviction firm.

“To improve standards and provide a better service, we acquired status as an Alternative Business Structure (ABS) in landlord and tenant law, authorised and regulated by the Solicitors Regulation Authority (SRA). This means if a landlord has a complaint, they can report it. But not all companies are regulated, so landlords have nowhere to turn if they have a complaint, and this needs to change. Belonging to a redress scheme would be the first step to making improvements and ensuring consumer confidence.”

The Head of Redress at the Property Redress Scheme, Sean Hooker, adds: “Eviction is a highly technical skill that should be conducted professionally and sensitively. It is also an area where practitioners should be very aware of the service they provide to their customers. This is where access to redress comes in, allowing landlords and their agents to have their service complaints determined by an independent and impartial third party and things to be put right. The introduction of such a provision will raise standards in the eviction world, provide customers peace of mind and confidence in the sector, and increase the reputation and standing of those specialists that provide a necessary and valuable service.”

Landlords, remember that Rent Guarantee Insurance is the best way to protect your rental income against tenant rent default. The policy from Just Landlords will also cover your legal expenses incurred when evicting a tenant: https://www.justlandlords.co.uk/rentguaranteeinsurance

Always remember to use a regulated eviction firm to avoid costly mistakes!