Rent prices rose across much of England, Wales and Scotland over August, according to the latest Buy-to-Let Indices from Your Move and Your Move Scotland.

Annual changes

The average rent in England and Wales during August was £904 per month, following annual growth in nine out of ten regions. This was caused by a rising number of tenants and the ongoing demand for more properties putting pressure on rent prices.

Rents in both the East of England and North West rose faster than any other region over the month. Both areas saw the average price increase by 3.2% in the 12 months to August. In the East of England, the average rental property let for £876 per month in August, while the average rent in the North West was £631. Close behind was the South East, where prices rose by 3% year-on-year, to stand at £882.

The South West was the only region to record a decline in rents over the past year. The average price in August was 2.7% lower than a year ago, standing at £667 a month. However, rents in the North East remain the lowest in England and Wales, at an average of £540.

London continues to be the region with the highest average rent, at £1,282 per month, following a 1.5% increase over the year. However, this headline figure masks large differences across the capital.

The average rental property in London’s Zone 2 is £1,952 – significantly higher than areas further from the centre. By comparison, the average rent in Zone 4 is £1,176 and £1,132 in Zone 5.

Rents Up Across England, Wales and Scotland in August

New tenant registrations have risen by around a quarter in London over the past 12 months. Your Move reported a drop-off in activity in the wake of the Brexit vote last summer, but the market has now returned to its usual activity levels.

Monthly changes

On a monthly basis, no region saw significant growth in rents between July and August. The best performers were the South West and Yorkshire and the Humber, where prices grew by an average of 0.4% month-on-month.

Three regions recorded a decline in rents between July and August – they were down by an average of 0.5% in the East of England, 0.5% in Wales and 0.1% in the North East.

Rental yields

Rental yields for landlords remained flat in most parts of England and Wales during August, Your Move found. The North East was the only region to see yields drop on a monthly basis, falling from an average of 5.2% to 5.1%.

However, landlords and property investors in the North East continue to enjoy higher returns than in any other region.

The North West, where the average yield was 5% during August, was the only other area to post a return of 5% or more. In London, the average yield was 3.2% in August – the lowest recorded. However, this return has remained steady throughout 2017.

Apart from the North East, each of the nine other regions saw yields remain level between July and August. The average yield across England and Wales now stands at 4.4% – the same as last month. However, this is down on the 4.9% recorded this time last year.

On an annual basis, each of the regions in this survey recorded lower yields than 12 months ago.

Tenants’ finances

The proportion of tenants in rent arrears fell in August, as the overall financial picture of the rental market improved. Your Move found that the percentage of households in England and Wales in arrears was 12.8% – lower than the 13.7% recorded in July.

The number of tenants in arrears remains below the all-time high of 14.6%, seen in February 2010.

The Director of Your Move, Richard Waind, says: “The strongest price growth continues to take place outside of London and the South East, with the East of England and the North West among the regions to grow faster in the last year. However, despite rising rents, the yields achieved by landlords continue to be squeezed.

“Following a drop-off in new tenant enquiries after the Brexit vote last year and a resulting decrease in EU migration figures, we have started to see a resurgence in tenants coming to the market in recent months, particularly in London. Figures are returning to the levels that we would expect around this time of year, with August and September being the busiest months for lettings, as students, graduates and families working in the education sector look for new properties.”

He adds: “This recovery in tenant enquiries, combined with continued subdued supply of new listings in the wake of recent tax changes affecting landlords, has been a key reason for price increases in the last year and could push rents up further in the coming months.”

Scotland

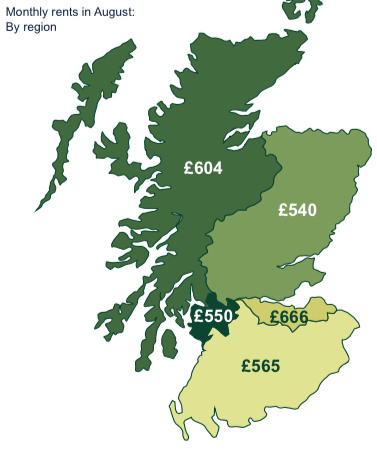

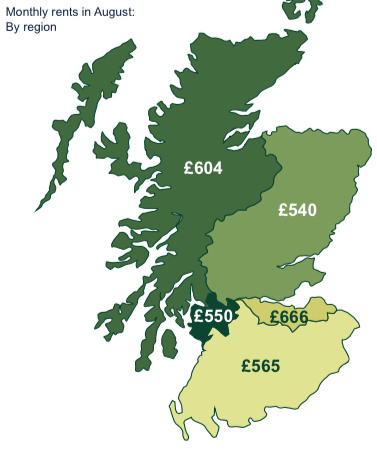

Average rents grew in four out of five regions in Scotland during August, taking the typical price to £579 per month – up by 0.7% on July and 0.5% on an annual basis.

Demand for rental properties continues to grow, causing prices to rise slightly at the end of the summer, due to restricted supply in popular areas.

The Glasgow and Clyde region was the only region to post a year-on-year decline, falling by 4.1% in the 12 months to August.

Edinburgh and Lothians remains the area with the highest average rent, at £666 per month – 4.1% higher than in August 2016.

At the opposite end of the scale, the East of Scotland region was home to the lowest average rent in August, at £540, although this is 2.5% higher than a year ago.

Across all of Scotland, landlords and letting agents should be preparing for the introduction of the Letting Agent Code of Practice in early 2018.

From 31st January 2018, agents in Scotland will be able to declare themselves compliant with this new legislation and join a Register of Letting Agents.

These changes are expected to cause significant disturbance for smaller agencies, with many expected to close or leave the market. Your Move Scotland is urging all landlords and property investors to enquire with their agent to ensure that they will be compliant with the new rules.

Letting agencies must have submitted an application to join the Code of Practice by 30th September 2018. From that point, it will be a criminal offence to conduct letting agency work if you aren’t on the register. Those breaking the rules could face a fine of up to £50,000 and up to six months’ imprisonment.

The rules are intended to increase professionalism in the sector, and make sure that agents are properly able to handle money received from both tenants and landlords.

Those invested in Scottish property once again received impressive returns in August. The typical property gave a 4.9% yield – exactly the same as in July. This is also the same rate of return as recorded in August 2016.

Throughout 2017, returns on Scottish property have been between 4.9-5%. This demonstrates the stability offered by the rental market in Scotland and the positive returns on offer to investors.

Looking at the whole of Scotland, around 10% of all tenancies had arrears of one day or more during August. This rate is a significant improvement on the previous month, when a rate of 16.6% was recorded, and on June’s arrears rate of 18.3%.

In real terms, the number of households in serious arrears – defined as two months or more – was 7,939 in August.

The Lettings Director at Your Move Scotland, Brian Moran, comments: “Rental prices are increasing across much of Scotland, thanks to high levels of demand and poor supply in many areas, with particular strain in Edinburgh, which saw prices rise by 4.1% over the year.

“Scottish landlords continue to see returns of close to 5%. It’s crucial that all landlords in Scotland start to prepare for the changes on

the horizon, such as Letting Agent Code of Practice, which is due to commence in early 2018.”

He adds: “Landlords should be talking with their agents now to make sure they are prepared for the changes and understand what it means for them, sooner rather than later.”