David Cameron Pledges £140m to Regenerate Run-Down Estates

In another housing policy, David Cameron has announced plans to regenerate 100 run-down estates in a £140m scheme.

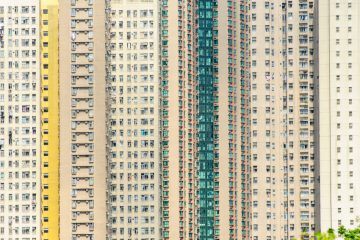

The Prime Minister explains that some housing estates will be transformed, while others will be demolished and replaced. He describes the estates as “brutal high-rise towers and dark alleyways” and “a gift to criminals”.

The pledge includes a right to return for all residents living in the estates. However, opponents question whether the rents of these homes will be at the same low level they are currently when they are replaced.

The Government hopes the plans will encourage third parties, such as pension funds, to help with housing regeneration.

John Healey, Labour’s Shadow Cabinet Minister for Housing, is not convinced by the plans.

David Cameron Pledges £140m to Regenerate Run-Down Estates

He remarks: “Another week, another housing announcement. If press statements build new homes, the Government would have the housing crisis sorted.

“People simply won’t see this small-scale scheme stretched over 100 estates making much difference to the housing problems in their area.

“Any extra to help councils build new homes is welcome, but Conservative ministers have halved housing investment since 2010 and are doing too little to deal with the country’s housing pressures.”1

The announcement is due today, but Mr. Cameron revealed the plans himself in a Sunday Times article. He believes that the policy will tackle issues that have “held people back”.

He states: “Decades of neglect have led to gangs and anti-social behaviour. And poverty has become entrenched, because those who could afford to move have understandably done so.

“The mission here is nothing short of social turnaround, and with massive regeneration, tenants protected, and land unlocked for new housing all over Britain, I believe we can tear down anything that stands in our way.”2

Mr. Cameron then spoke on the BBC’s Andrew Marr Show, defending the new policy: “I think sink housing estates, many built after the war, where people can feel trapped in poverty unable to get on and build a good life for themselves.

“I think it’s time, with Government money, but with massive private sector and perhaps pension sector help, to demolish the worst of these and actually rebuild houses that people feel they can have a real future in.

“We should have a big shift towards more affordable housing to buy. Of course you always need some affordable housing for rent.”2

The Secretary of State for Communities and Local Government, Greg Clark, adds: “You’ve got estates that are showing their age [and were] perhaps badly designed when they were first built sometimes in the 1960s or 1970s.

“We’ve learnt a lot since then. We actually want to work with local communities to build more homes and a better future for existing tenants there.”2

The Independent reports: “Given this is to be split across 100 estates, that should allow for a few repainted front doors and giant wheelie bins then.

“Anyone who grew up on an estate knows the biggest problem is the inexorably suffocating economic and social nihilism. If there’s nowhere and nothing better to aspire to, then frustration turns to resentment and eventually, anger.

“100 unnamed estates? A not clearly earmarked £140m – when even ten times as much is not enough? Vague promises of private sector and pension sector funding? Halving the amount invested in housing since 2010? You really can’t fool all the people all the time, whether they live on council estates or not.”3

The British Property Federation (BPF) has welcomed the plans, praising the pledge for “binding guarantees” to be enforced for tenants and homeowners, ensuring their right to a home is protected.

Director of Policy at the BPF, Ian Fletcher, comments: “There are some very old council estates that are in need of regeneration, but that process must treat existing residents fairly.

“The Government is therefore right to put some sorts of guarantees at the forefront of its policy and encourage a partnership approach. There are investors in our membership, pension funds and the like, who will be very interested in how they can contribute to those partnerships.

“Communities need not only homes, but jobs, schools and green spaces and other leisure opportunities to create places people want to live in. If the Government gets this right, it could be some of the best use of £140m it has ever spent.”4

1 http://news.sky.com/story/1619875/brutal-estates-to-get-140m-regeneration

2 https://www.gov.uk/government/speeches/estate-regeneration-article-by-david-cameron

4 http://24dash.com/news/housing/2016-01-11-PM-pledges-140m-to-transform-sink-housing-estates