Those already on the property ladder may not know how hard the housing crisis is hitting, but many are finding out, as their adult children move back into the family home.

New research reveals that a fifth of young adults are living in their parent’s home until they are at least 26-years-old. The same proportion do not pay their parents anything for living at home.

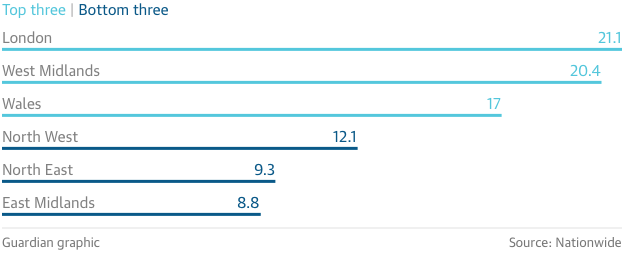

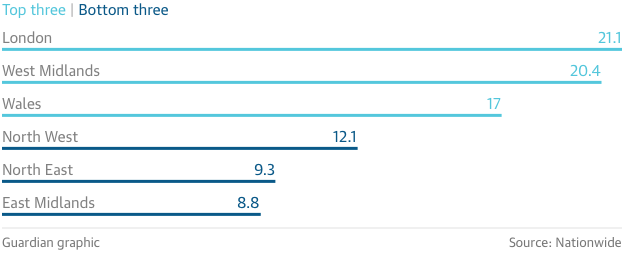

A study by Nationwide found that the percentage of young adults living at home varies across the country, from under 9% in the East Midlands to more than double that in London, where house prices and rents are the most expensive. While most pay their parents something, 20% pay nothing at all.

Young adults are suffering from low wages and record high rents, while those hoping to buy a home of their own are finding that the monthly cost of renting is preventing them from saving.

Housing charity Shelter reveals that half of private tenants cannot save anything towards a deposit, while a quarter can only put £100 or less aside each month.

Although mortgages are cheaper than ever, due to record low interest rates, the best deals are for those with large deposits.

Percentage of over-18s living with their parents

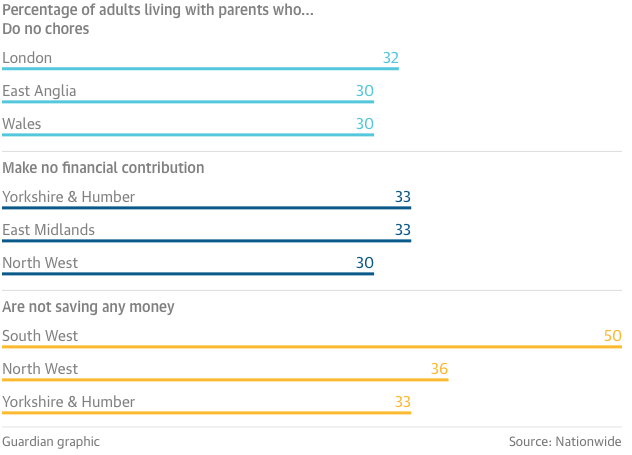

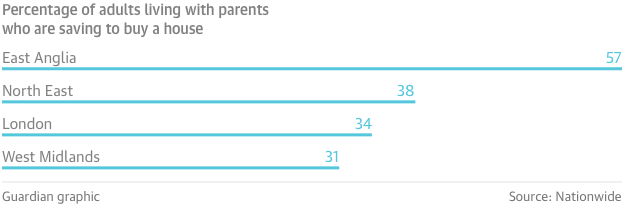

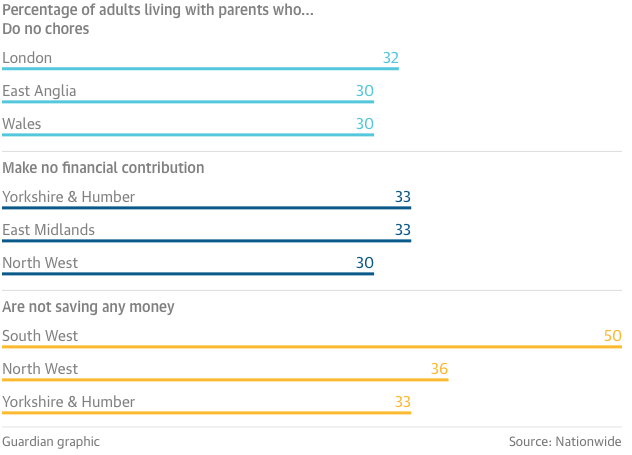

As such, young adults are increasingly moving back in with their parents in order to save money. Nationwide discovered that 28% of adults are living at home because they are trying to save a deposit. However, the building society also found that 30% are not saving any money.

A spokesperson for Nationwide says: “The hotel of mum and dad is often staying open for longer than many anticipated, our latest research shows. Rental costs and deposits or the need to save for a mortgage deposit mean that some children understandably have to wait before flying the nest. And, for some, moving out may never be an option.”1

Michael Day is 30-years-old and lives with his parents and older brother in Bristol. Renting a one-bedroom flat in the city costs between £500-£800 per month, while buying a similar home would cost around £130,000.

He comments: “I don’t really want to move out to rent as it’s more than a mortgage, but you need such a big deposit to get a mortgage so it’s been a bit of a vicious circle.”1

Additionally, Michael does not want to share with strangers. At home, he pays minimal rent to cover bills and keeps the rest of his earnings for himself. However, he admits that he spends spare cash on holidays and golf, as he plays at county level.

Sue Green, from Saga, which sells insurance and products to the over-50s, says the majority of parents may not have planned to have their children living with them into adulthood.

She explains: “Most will be more than happy to house them in the family home rent-free because it might help their kids get on the property ladder sooner. Children who don’t pay rent may contribute in other ways like buying groceries, family takeaways or doing odd jobs around the home.”1

Young adults contributing at home

Co-founder of think-tank the Intergenerational Foundation, Angus Hanton, says older generations are “the architects of the housing crisis” and young adults should not be blamed for staying at home.

He reports: “The under-30s have suffered a fall in average incomes of about 20% since the 2008 downturn. Rents and car insurance have never been so high, and mortgage lending rules have been tightened for the young but not for older buy-to-let investors, who squeeze out the young.

“Student-free debt is rising rapidly, yet many jobs on offer – zero-hours and short-term contracts – are turning younger workers into second-class citizens. Rather than blaming the young, we should be standing up for their interests so they can afford to build lives of their own.”1

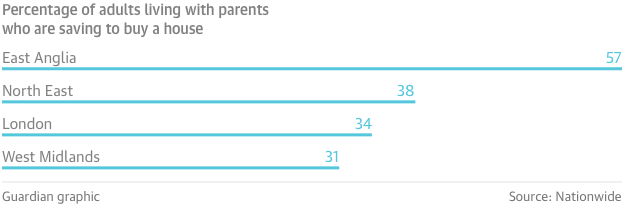

Percentage of adults living at home saving for a property

Jenna Gavin, 29, lives in the home she grew up in in Southport, Merseyside. She moved out for a year to go to university, but has been living with her parents since. She now works as a medical receptionist nearby, but renting in the area would cost over £420 a month before bills, which would take up a lot of her income.

She states: “I don’t want to rent; I don’t want to spend all that money and have nothing at the end. I’ve looked at buying and seen mortgage advisers, but I just can’t borrow enough to get on the property ladder.”

Jenna is trying to save, but it’s a struggle: “You don’t really see it building up as much as you need – even a 5% deposit is such a lot of money and I would like to put down more.”

But her parents are happy not to charge her rent: “They want me to try to save up and I contribute in other ways – I bring food in and I do things around the house.”

Jenna has her own space, but this is the bedroom she moved into when she was 14; she always imagined having her own house by the time she was 30: “I don’t see that happening, as it’s next year, so hopefully in a couple of years I’ll have moved out.”1

Are your children still living at home? Or are you struggling to get on the property ladder?

1 http://www.theguardian.com/money/2015/oct/23/home-invasion-adults-live-with-parents-26-house-price-family