Annual House Price Growth Eases in June

Annual house price growth eased off in June, down from 9.2% in May to 8.4%, according to the latest House Price Index from Halifax.

The report found that the annual rate of house price growth seen in the three months to June is the lowest since July 2015, when it was 7.8%.

Over the quarter, house prices were 1.2% higher in the three months to June than in the preceding three months (January to March). This was slightly below May’s 1.5% increase and is the lowest

Annual House Price Growth Eases in June

rise on this basis since December 2014.

On a monthly basis, house prices rose by 1.3% between May and June, following a 0.9% increase in May. However, the report notes that month-on-month changes can be erratic, and the quarterly data is a more reliable indicator of underlying trends.

The average house price in the UK now stands at £216,823.

The Housing Economist at Halifax, Martin Ellis, comments on the figures: “There is evidence that the underlying pace of house price growth may be easing. House prices in the three months to June were 1.2% higher than in the previous quarter, down from 1.5% in May. The annual rate of growth fell from 9.2% in May to 8.4%, the lowest since July 2015.

“House prices continue to increase, albeit at a slower rate, but this preceded the EU referendum result, therefore, it is far too early to determine any impact since.”

The latest research by estate agents suggests that property sales and new instructions have surged since the Brexit outcome.

Halifax has found that home sales stabilised in May, following the introduction of the 3% Stamp Duty surcharge for buy-to-let landlords and second homebuyers in April.

A rush to complete sales ahead of the tax hike caused a sharp rise in March, followed by a significant decline in April. However, sales stabilised in May, rising by 1.5%. Despite this, the number of sales recorded over the month (89,700) remained 16% below the average over the six months to February.

The index also shows that mortgage approvals rose modestly in May, after the Stamp Duty change affected the market. The volume of mortgage approvals for house purchase – a leading indicator of completed property sales – rose by 1.3% between April and May. However, approvals in the three months to May were 6% lower than in the previous three-month period.

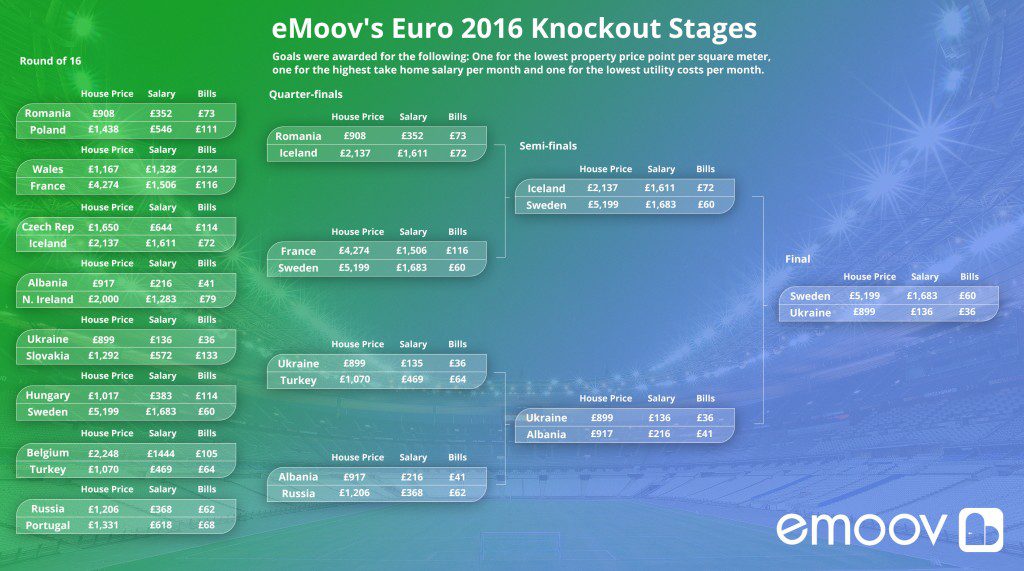

The founder and CEO of online estate agent eMoov.co.uk, Russell Quirk, comments on the data: “Today’s figures show, even in the wake of Brexit, that the UK housing market is fundamentally strong. With a continuing, acute shortage of new housing being built and a growing population, even if immigration numbers are now curtailed, the demand vs. supply imbalance and the prospect of even low interest rates will underpin the market – even if there are short-term confidence wobbles fuelled by a media hungry for bad news.”