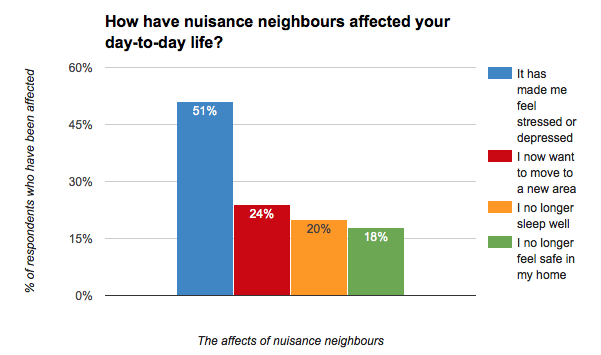

A new study has found that 18m people, or a third of the UK’s adult population, have faced neighbour disputes in the past year and half of those have been left feeling stressed or depressed as a result.

The survey, conducted on behalf of mortgage broker Ocean Finance, found that 38% of residents no longer feel safe in their own homes or struggle to sleep due to stress caused by neighbours. A further 24% want to move to a new area to escape the issue.

Most respondents that have suffered from a neighbour dispute have experienced more than one problem.

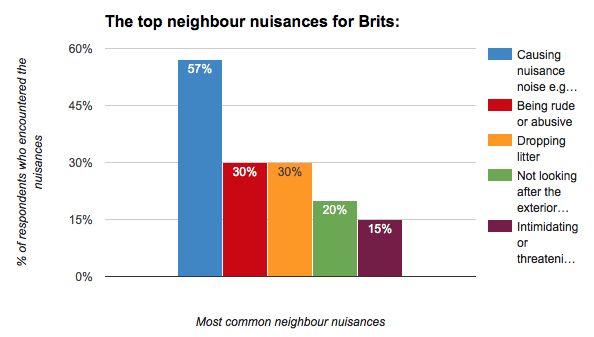

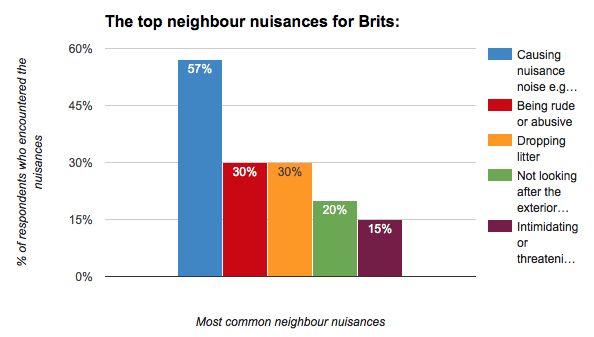

Of those that have experienced difficult neighbours, the most common issue is excessive noise (suffered by 57% of residents), including stomping around the house, loud arguments and late-night parties. About 30% have witnessed rude or abusive neighbours and another 15% said their neighbour has used intimidating or threatening behaviour.

A further 50% complained that their neighbour does not look after the exterior of their property or that there are problems with litter and rubbish being dumped, ruining the community.

On a regional basis, London has the highest number of incidents, with 52% of residents saying they have encountered some form of nuisance neighbour during the last 12 months.

Those living in Wales are least likely to suffer difficult neighbours (at 26%), compared with the national average of 36% of residents.

Respondents from Northern Ireland, the North West and South West of England were most likely to suffer a neighbour that uses intimidating or threatening behaviour, with those in the North East the least likely.

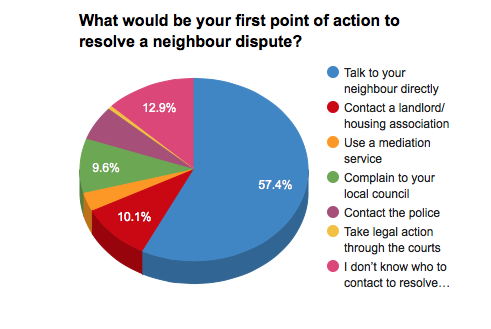

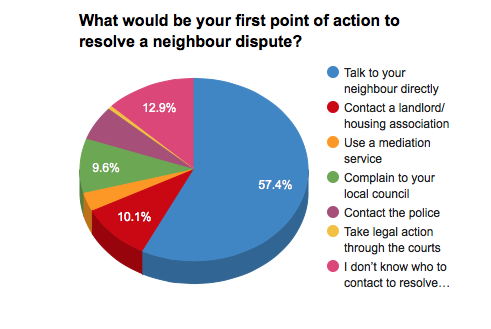

Around 13% of respondents, equivalent to 7m Britons, admitted that they do not know which organisation to contact regarding a neighbour dispute. Over half of those affected (57%) would combat the issue directly, while just 16% would contact the police or their local council.

The Government advises residents to deal with a neighbour dispute by following these steps:

- Speak to your neighbour.

- If your neighbour is a tenant, contact their landlord.

- Use a mediation service.

- Complain to the council.

- Call the police.

- Take legal action.

A spokesperson for Ocean Finance, Gareth Shilton, states: “The research highlights the devastating impact that problem neighbours can have on the lives of people in our communities. Loud noise, dumped rubbish, shabby houses, even threats and abuse are causing misery for millions of people who live in fear.

“It’s understandable that people may feel worried about tackling the problem of nuisance neighbours. There are organisations that can support residents with these problems and give advice on how to deal with neighbour disputes so they can start to feel safe in their homes again.”

Have you ever suffered a neighbour dispute? Or is this something that affects your tenants?

For more information on Ocean Finance’s research, click here: https://www.oceanfinance.co.uk/blog/the-uks-most-common-neighbour-nuisances-and-effects-0-4670-0.htm