How much Living Space can you Rent for $1,500 per Month Around the World?

Many tenants across the globe will be used to the fact that they won’t get much living space for their monthly rent. But how much living space can you rent for $1,500 per month around the world?

If you rent in a big city, size seems to get compromised on very often. If you don’t want to compromise on size, then this seems to be at the expense of location – what a great time to rent!

RENTCafé has found out how much living space you can get for the same amount of rent each month in the 30 most magnetic cities around the world, to show you where you’d be better off renting.

But what makes these cities magnetic? RENTCafé has used the Mori Memorial Foundation’s Institute for Urban Strategies’ Global Power City Index, which ranks each city in terms of its attractiveness, based on six main criteria: economy, research and development, cultural interaction, liveability, environment, and accessibility.

Using the 30 top cities included in this index, RENTCafé then calculated how much living space you can rent for $1,500 per month in each location.

The study found that you can rent three times more space in Shanghai than in Los Angeles for $1,500 per month, while the price per square foot in San Francisco is five times higher than in Berlin – basically, the German capital would offer you five times more living space than San Francisco for the same amount of money.

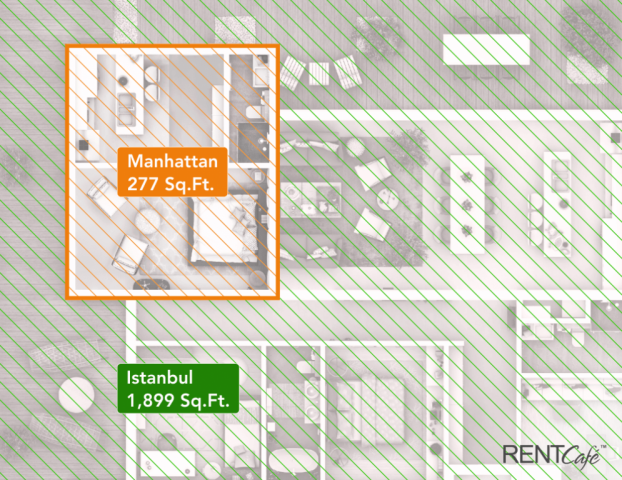

It may be hard to picture this, so below is the comparison between the size of an apartment in Istanbul and Manhattan, where you’ll get seven times less living space than in the Turkish city:

The research reveals that four Western European cities compete with Manhattan, San Francisco and Hong Kong in terms of high price per square foot. London, Paris, Zurich and Geneva all offer less than 350 square foot for $1,500 per month.

How much Living Space can you Rent for $1,500 per Month Around the World?

To offer some shocking contrasts, RENTCafé has compared the following cities:

Manhattan vs. Seoul

Boasting a high ranking in the Global Power City Index in terms of research and development, economy and cultural interaction, New York City is the second most magnetic global hub, making it a desirable place to call home. Therefore, it doesn’t come as a surprise that Manhattan only offers 277 square foot for $1,500 per month in rent.

Similar to New York in terms of architecture, entertainment and employment options, Seoul tells a different story where living space is concerned. In South Korea’s capital, the same amount of money will rent you no less than 1,389 square foot, which means that you get to make yourself at home in a highly generous living space. The top educational system, the remarkable public transportation network and the modern yet traditional allure make for an amazing city to call home.

San Francisco vs. Vienna

Smaller, less hustly-bustly and slightly less expensive than New York City, San Francisco is among the most coveted cities in the world. There is no shortage of cultural diversity and entertainment options there. For $1,500 per month, you can rent a 316 square foot apartment in the Golden Gate city and enjoy the perks of living in one of the best places of opportunity in the USA.

If you’d rather not downsize, the good news is that you can triple your living space by moving to Austria. A monthly sum of $1,500 would rent you 1,099 square foot of living space in the city of Vienna, making it one of the most affordable Western European cities. Here, wellness meets opportunity, so your career is sure to be in good hands. The City of Music also offers you a wide range of museums, vintage cinemas, live shows, recreational parks and hiking trails.

What a difference! Does this make you want to move to the other side of the world?