London is the weakest performing region for house price growth for the first time since 2005, with the average property value down by 0.6% on an annual basis in September, according to the latest House Price Index from Nationwide.

Across the whole of the UK, annual house price growth was stable in September, at an average of 2.0%. This is down slightly from 2.1% in August. On a monthly basis, prices rose by 0.2%, which is up on the -0.1% rate recorded in the previous month. The average house price in the UK now stands at £210,116.

The Chief Economist at Nationwide, Robert Gardner, comments on the figures: “Housing market activity, as measured by the number of housing transactions and mortgage approvals, has strengthened a little in recent months, though remains relatively subdued by historic standards.

“Low mortgage rates and healthy rates of employment growth are providing some support for demand, but this is being partly offset by pressure on household incomes, which appear to be weighing on confidence. The lack of homes on the market is providing ongoing support to prices.”

He continues: “House price growth rates across the UK have converged in recent quarters. Annual growth rates in the south of England have moderated towards those prevailing in the rest of the country. London has seen a particularly marked slowdown, with prices falling in annual terms for the first time in eight years, albeit by a modest 0.6%. Consequently, London was the weakest performing region for the first time since 2005.

“At its September meeting, the Bank of England’s Monetary Policy Committee (MPC) signalled that, if the economy evolves broadly in line with its expectations, an interest rate increase is likely in the months ahead. This would be the first increase in the bank rate since July 2007.”

Gardner looks ahead: “Clearly, much will depend on how the economy evolves, but most economists and financial market pricing suggest that a small rise of 0.25% is likely at the MPC’s next meeting in November, which would take bank rate to 0.5%.

“We would expect a modest rise in bank rate, by itself, to have only a modest impact on economic activity. Indeed, if rates are raised to 0.5%, monetary policy settings will still be a little more supportive than they were before bank rate was lowered to 0.25% in August 2016.

“This is because the MPC is unlikely to reverse the other measures it put in place last year to support credit availability in the wider economy (such as the additional purchases of Government and corporate bonds, which have helped to keep longer-term borrowing costs low). Moreover, the MPC has signalled that it expects any increase in interest rates to be gradual and limited. Indeed, financial market pricing suggests that bank rate is only likely to rise by around one percentage point (to 1.25%) over the next five years.”

So how much of a squeeze would this exert on households?

Gardner explains: “Providing the economy does not weaken further, the impact of a small rise in interest rates on UK households is likely to be modest. This is partly because the proportion of borrowers directly impacted will be smaller than in the past. In recent years, the vast majority of new mortgages have been extended on fixed interest rates

“The share of outstanding mortgages on variable interest rates (and which are therefore likely to see an increase in payments if bank rate is increased) has fallen to its lowest level on record, at c.40%, down from a peak of 70% in 2001.

London House Prices Drop for First Time in 8 Years

“Moreover, a 0.25% increase in rates is likely to have a modest impact on most borrowers who are on variable rates. For example, on the average mortgage, an increase of 0.25% would increase monthly payments by £15 to £665 (equivalent to £180 per year).”

He carries on: “That’s not to say that the rise will be welcome news for many borrowers. Household budgets are already under pressure from the fact that wages have not been rising as fast as the cost of living. Indeed, in real terms (i.e. after adjusting for inflation), wage rates are still at levels prevailing in 2005.

“Moreover, some households already have a relatively high debt service burden. For example, the English Housing Survey suggests that around 12% of households already spend over 30% of their gross income on their mortgage each month. For these households, some of which will be on variable rates, the rise will be a struggle, even though the impact on the wider economy and most households is likely to be modest.”

Gardner adds: “A first increase in interest rates for ten years will be welcomed by savers, though it is likely to provide limited relief. An increase in bank rate will not be passed on to all savings accounts (for example, we estimate that around 15% of balances are on fixed rates) and, even where the rise is passed on in full, rates will remain low by historic standards.”

Nationwide has also released its Quarterly Regional House Price Statistics for the third quarter (Q3) of the year, finding that the East Midlands was the top performing region.

Annual house price growth across all UK regions remained within a fairly narrow range once again in Q3, while prices were up by an average of 5.1% in the East Midlands year-on-year. This is the first time since 2002 that the region has taken the top spot.

London was the only region to record a yearly price decline, with an average drop of 0.6%. This is the first time since Q3 2009 that London house prices have fallen on an annual basis.

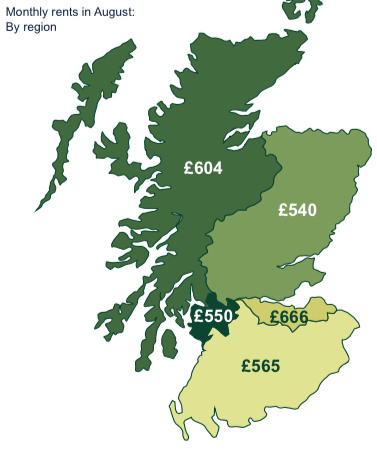

Northern Ireland saw a softening in annual growth to 2.4%, from 3.8% in the previous quarter, while Wales experienced a slight pick-up, to 2.6%. In Scotland, annual price growth was similar to Q2, at 1.9%.

The average house price in England rose by 0.7% during Q3 and was up by 2.3% over the past 12 months.

Continuing the pattern seen in Q2, price growth in northern England (the West Midlands, East Midlands, Yorkshire and the Humber, the North West and north) exceeded that in southern England (the South West, outer South East, Outer Metropolitan, London and East Anglia). Northern England witnessed a 3.2% annual increase, while prices increased by 1.9% in the south.

Although price growth in the south has slowed, the gap in cash terms between southern and northern England is still exceptionally high, at £171,000 – a figure that has doubled over the last decade.

The Founder Director of independent estate agent James Pendleton, Lee James Pendleton, offers his comment on the latest data: “The bellwether has turned, but it’s a really positive thing because it’s going to get the market moving.

“London has been the torchbearer of quite unbelievable growth in recent years, but it has been an overvalued market for at least the last three years. This shows vendors and agents are becoming more realistic, but you’ve got to use an agent that is going to tell you what you need hear. People have got so used to prices going up and the result is too many people have been priced out. London cooling is going to really engage buyers and put us on a better, more stable footing towards the end of the year.”

He insists: “People have got to get out of the habit of thinking of their property as an investment but as a home, quite soon they may not have any choice. The most surprising thing of all is how the capital managed to keep up its march skyward for so long. There have been so many headwinds but an era of cheap borrowing has seen buyers refuse to be intimidated. That period of bravado now seems to have come to an end as the capital’s fortunes diverge from those of every other region.

“Within the UK market, the ripple effect always begins in London, with the Home Counties and regions benefitting further down the line. They still are it seems, and the effects of London finally easing off the gas will take some time to trickle through.

“Annual house price growth nationally may be stable, but it’s still way off the pace of inflation. Threadneedle St has also been very careful to prepare everyone for a rate rise soon, if not this year. I expect all this to seriously focus the minds of homeowners having to make those all important decisions on how much to pay, how much to borrow and whether to move home at all until that much trailed rate rise arrives.”

Russell Quirk, the Founder and CEO of online estate agent eMoov.co.uk, also comments: “It is not surprising that the UK’s market stabilises as we head into the busy autumn selling season, after a slowdown during August. London’s stall in growth during September is likely a continued ripple effect from the summer holidays, as schools opened their doors and potential homebuyers were getting back into a routine with family. There are optimistic signs that the resilient London market will catch up to the rest of the UK in the coming months.”

The Editor in Chief of money.co.uk, Hannah Maundrell, adds: “The market seems to be cooling slightly in London, which will hopefully give people more of a chance to get on the housing ladder – despite still being the most expensive region.

“Prices are still on the rise for the rest of the country, with the East Midlands seeing the greatest price increase. It’s important here to make sure you do your research before you buy to get the best deal.

“If you’re looking to buy in the capital, power could be tipping in your balance, so make sure you do your research and haggle to get a price you’re happy with. If you’re selling, make sure the price you’re asking is realistic and be confident about the minimum you’re able to accept. If you want to sell at the top end of the price scale, you’ll need to make sure your home is better than anything else out there, and be prepared to wait for someone that wants to pay a premium.”