There are still ‘attractive yields to be had’ in the Buy To Let sector

The current level of demand for rental properties is showing no sign of slowing down any time soon, and this seems to be placing upwards pressure on rental prices.

As it stands as the moment, the average rent (outside of London) comes to a record-high £758 per month. In London however, average rental prices come in at £1,537, according to Homelet’s rental index. These rates are up by an average of 1.21%, according to Landbay. With such a growing disparity between the demand for rental properties and supply, it seems no surprise that the rental prices for available homes are on the increase.

The buy-to-let sector has long been a secure place for investors looking to make great returns on their assets. However, there have been several factors affecting the industry in recent years, and this year especially has seen changes that property owners, landlords and prospective investors have had to take into account. With a decrease in people who own homes, These include the 3% stamp duty levy introduced on buy-to-let properties, as well as the new EPC legislation and of course, tax relief on buy-to-let mortgage interest now being phased out.

The UK’s average rent outside London comes in at a record-high £758 pcm

What does this mean for the future of buy-to-let properties?

The future of the buy-to-let market may still seem like it’s been going through a lot of changes. It seems many experts believe the amount of landlords (and property owners alike) is likely to plateau or drop over the next few years, as investors begin to feel the pinch from the new regulations coming into place.

With so many tenants reliant on the privately rented sector, and with demand and rent prices alike increasing, this seems a trend which is likely to continue.

As of the financial year ending in 2017, the latest estimate of a UK household’s disposable income comes in at an average of £27,300. Rent prices outside of London will account for 52% of this, and inside London, almost 89% of disposable income is spent on rent.

Commentary

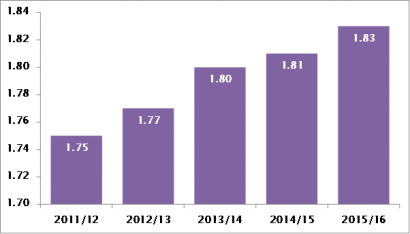

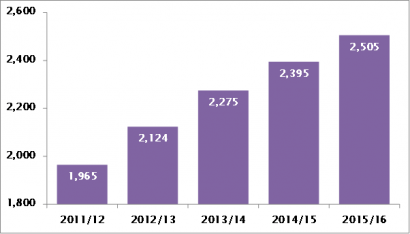

John Goodall, CEO and founder of Landbay, said: “Rents have continued to rise over the last five years, increasing by 9% across the UK since March 2013 and by 7% in London – with monthly payments remaining a burden on those struggling to save.

“Tenants saving up for a house face a triple challenge with more and more of their income spent on rent, partnered with trying to catch up with the pace of house price inflation and record low interest rates limiting their ability to save money.

“There has been much speculation about the long-term future of the buy to let sector from an investment perspective, however, demand remains strong as brokers would attest. Not a day goes by when there isn’t more news about the supply-demand mismatch in the UK housing sector and until this is resolved, tenants will continue to rely on the private rented sector to support them.”