What are Tenants Really Looking for in their Rental Homes?

Whether you are considering expanding your portfolio by investing in a new property, or are preparing to re-let any of your existing investments, it is important to understand what tenants are looking for in their rental homes.

Of course, different tenants have different needs, but property portal Zoopla has attempted to establish some common factors that appeal to all kinds of renters.

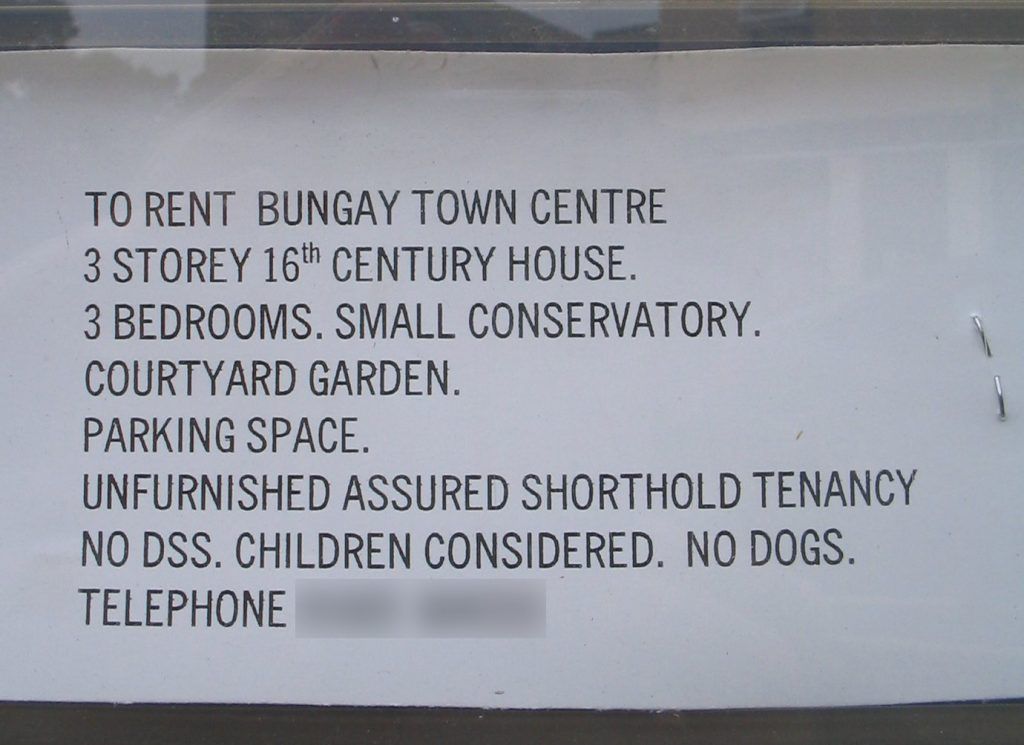

The research found that parking is the number one requirement for private tenants, while pet-friendly rental homes are growing in popularity, with the search term ‘pets’ ranking as the third most popular across Great Britain.

Zoopla analysed search data from its keyword property search tool, to reveal the nation’s most sought-after features in rental homes. Aside from ‘parking’, ‘garage’ and ‘furnished’ also ranked highly.

The findings come at a time when the average motorist in the UK spends 91 hours per year looking for a parking space, according to the British Parking Association (BPA).

Annabel Dixon, the Spokesperson for Zoopla, says: “Parking and garages were a consistent requirement for tenants across the nation. While this may not be the most exciting feature of a home, our research clearly shows that landlords can make their properties much more attractive by creating or enhancing existing parking. Whether they re-landscape their garden to include a driveway or apply to drop the kerb outside their house, these changes could pay dividends.”

Top ten keyword searches

- Parking

- Garage

- Pets

- Furnished

- Garden

- Student

- Bills included

- Balcony

- Bungalow

- Detached

On a regional level, tenants in London commonly searched for ‘gym’ and ‘ensuite’, yet these terms did not appear in the top ten requirements for renters in any other region of the country.

Meanwhile, those in Scotland have arguably less demanding requirements, with ‘dishwasher’ making it into the top ten.

In the North East and South West, tenants are after countryside dwellings, with ‘rural’ and ‘cottage’ featuring on tenants’ wish lists, while renters in the North West clearly enjoy the great outdoors, with ‘garden’ and ‘balcony’ making the top ten.

Zoopla also analysed viewings data to reveal the most viewed rental homes across the nation. Unsurprisingly, three-bedroom houses are the most frequently viewed properties on the portal. This was the case for every region, except London, where two-bed flats pipped them to the post.

Dixon adds: “From gyms to balconies, right through to dishwashers, it is fascinating to see how the requirements of renters differ across all regions of Great Britain. With Londoners paying a premium in rent, it makes sense that these tenants are focused on high quality amenities and luxury features, whilst renters in more rural locations are looking for properties that make the most of their countryside setting.

“Three-bedroom houses have come up trumps in our ranking of the most viewed properties by house hunters. These homes appeal to a wide range of buyers and tenants, including young families who are looking for space to grow, as well as downsizers who want a more manageable space that can still accommodate visitors.”

Landlords, use this data to ensure a successful let when putting your property onto the rental market!